The Current International Monetary System Is Best Described as a

And iii a collection of institutions rules and conventions that govern its operation. The international monetary system is the structure of financial payments settlements practices institutions and relations that govern international trade.

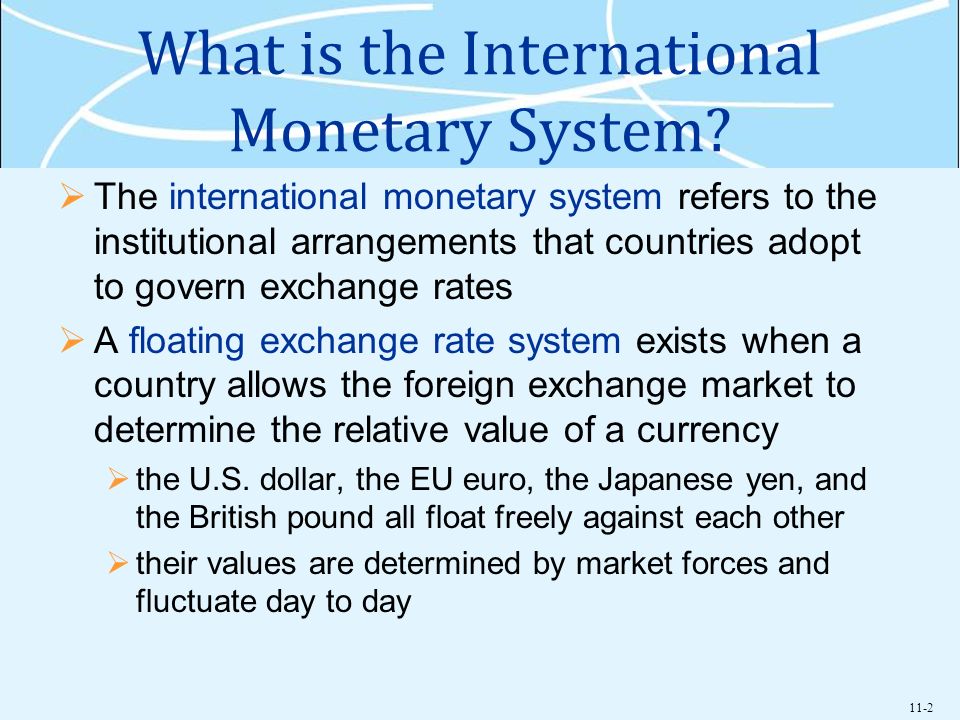

The Role Of The International Monetary Fund In A Changing Global Landscape Center For Strategic And International Studies

What Is the International Monetary System and How Should It Function.

. The current international monetary system can be called Select one. D the durability and desirability. At the time the US dollars convertibility into gold served as an external monetary anchor and currencies were tied together through fixed but adjustable exchange rates Domestic monetary regimes in general gave less priority to price stability and more to.

Such institutions include the mint the central bank treasury and other financial institutions. Abstract The dollar crisis of August 1971 clearly constituted a threat to the Bretton Woods parity system but it also challenged the most fundamental underpinning of the Bretton Woods order the belief in a general and progressive liberalization of international trade and payments. These core elements are supplemented in two important ways.

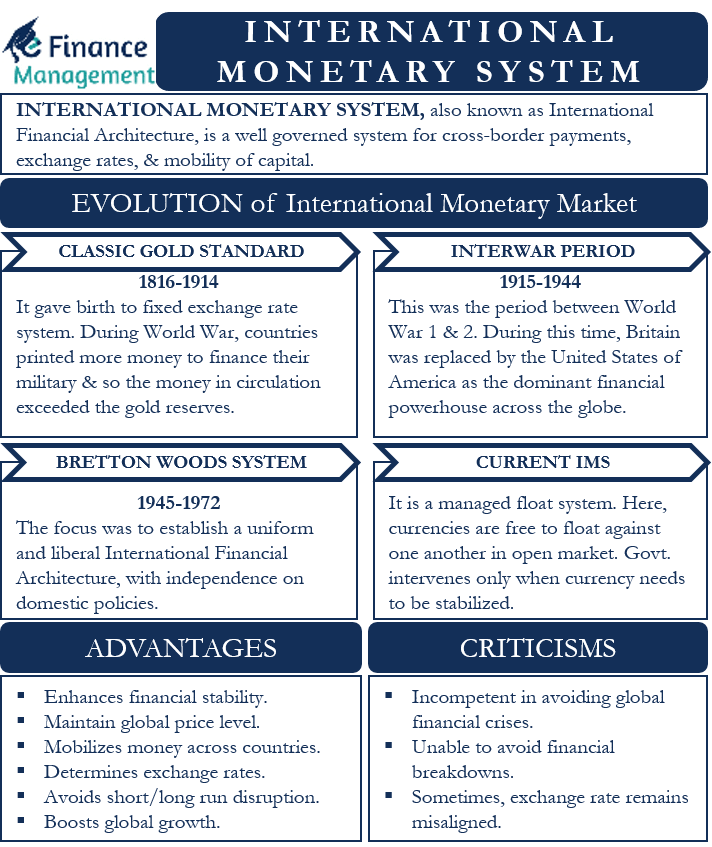

International monetary system refers to the system prevailing in world foreign exchange markets through which international trade and capital movement are financed and exchange rates are determined. International monetary systems are sets of internationally agreed rules conventions and supporting institutions that facilitate international trade cross border investment and generally the reallocation of capital between nation states. A Monetary System is defined as a set of policies frameworks and institutions by which the government creates money in an economy.

B a general willingness to accept fiat money. Refers to the system and rules that govern the use and exchange of money around the world and between countries. C is currently the basis for the international monetary system d is currently in use only by the major industrial nations e none of the above.

Its stated mission is working to foster global monetary cooperation secure financial stability facilitate international trade promote high employment and sustainable economic growth and reduce poverty around the. And iii a collection of institutions rules and conventions that governs its operation. Easy 310 Managed floats do NOT fall into which of.

The international monetary system provides the institutional framework for determining the rules and procedures for international payments determination of exchange rates and movement of. The largest holders of international reserve assets are 2016. Lets take a look at the last century of the international monetary system evolution.

The International Monetary Fund IMF is an international financial institution headquartered in Washington DC consisting of 190 countries. The international monetary system consists of i exchange rate arrangements. Domestic monetary policy frameworks are essential components of the global system.

And iii a collection of institutions rules and conventions that governs its operation. Finance questions and answers. The current exchange rate system can best be.

A flexible exchange rate system because the value of a currency is. A managed float exchange rate system because currencies are allowed to fluctuate but government central banks intervene when a currency is considered over-valued or under-valued. The current international monetary system is best described as a.

China 32 trillion more than 25 of. Flexible exchange rate system. A free floatb managed float c fixed-rate d hybrid Ans.

Managed flexible exchange rate system. Domestic monetary policy frameworks dovetail and are essential to the global system. Exchange rates between any two currencies will adjust to reflect changes in the relative price level of the two countries.

The international monetary system refers to the system and rules that govern the use and exchange of money around the world and between countries. The American action and the manner of its implementation appeared to herald a protectionist. The international monetary system consists of i exchange rate arrangements.

The current exchange rate system can best be characterized as a a free float b managed float c target-zone arrangement d fixed-rate system e hybrid system. The international monetary system consists of i exchange rate arrangements. They provide means of payment acceptable between buyers and sellers of different nationality including.

These core elements are supplemented in two important ways. This preview shows page 3 - 6 out of 8 pages. Since 1973 the amount of intervention by national monetary authorities has not declined.

The international monetary system refers to the operating system of the financial environment which consists of financial institutions multinational corporations and investors. Each country has its own currency as money and the. Fixed exchange rate system.

It should provide means of payment acceptable to buyers and sellers of different nationalities including deferred. An international monetary system is a set of internationally agreed rules conventions and supporting institutions that facilitate international trade cross border investment and generally the reallocation of capital between states that have different currencies. The current exchange rate system can best be characterized as a ___ system.

C a short memory of what actually transpired under the gold standard. The current system of exchange rate determination Level. International monetary system refers to a system that forms rules and standards for facilitating international trade among the nations.

And payments around the world. Current arrangements differ markedly from the previous system Bretton Woods 1946-73. Flexible exchange rate system.

The current international monetary system is best described as a a. It helps in reallocating the capital and investment from one nation to another. The current system is a managed float rather than pure or clean float.

Fixed exchange rate system. International monetary system The system and rules that govern the use of money around the world and between countries. History of the International Monetary System There have been four phases stages in the evolution of the international monetary system.

Managed flexible exchange rate system. A fundamental distrust of governments willingness to maintain the integrity of fiat money.

This Needs More Graphic And Less Info Teaching Economics Economics Lessons Macroeconomics

The International Monetary System Ppt Video Online Download

Challenges Faced By International Monetary Fund Imf And The Ways Of Dealing With Them Research Methodology

Reading What Is The Role Of The Imf And The World Bank International Business

Browse In Book Journal Issue Imfsg

Sanctions And The International Monetary System Vox Cepr Policy Portal

The International Monetary System Ppt Video Online Download

Money The Intersection Of Money A Global Snapshot Financial Literacy Money Infographic

The International Monetary System Ppt Video Online Download

The International Monetary System Ppt Video Online Download

The International Monetary System Ppt Video Online Download

Monetary System Intelligent Economist

Sanctions And The International Monetary System Vox Cepr Policy Portal

Global Financial Stability Report October 2021 Covid 19 Crypto And Climate Navigating Challenging Transitions Imfsg

International Monetary System Meaning Evolution Criticisms More Efm

Dana Moneter Internasional Wikipedia Bahasa Indonesia Ensiklopedia Bebas

Pin By Allen Noriega Inc On Career Business Consultant Services Business Business Management

Comments

Post a Comment